string(106) "background-image: linear-gradient(to bottom, transparent 50%, #FFFF00 50%, #FFFF00 100%, transparent 100%)"

string(12) "------------"

Sign up today and get $50 bonus

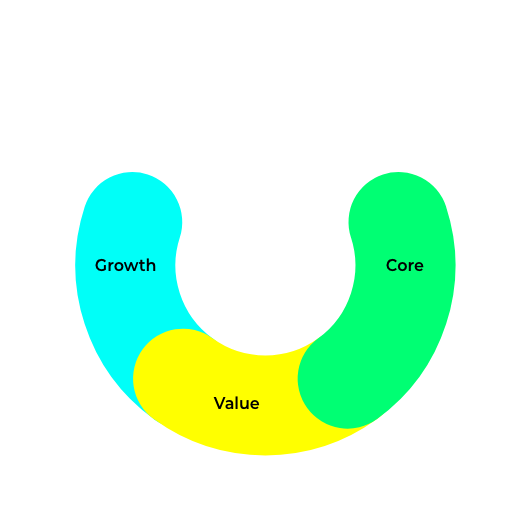

Tenjin AI Cruiser adopts a thematic investment and a diversified universe of ETFs. It seeks to identify high quality growth ETFs that can deliver superior risk-adjusted returns and sector-level exposure to your portfolios.

Investing Style | Long Terms |

Number of ETFs | 20 to 25 |

Average Market Cap | Over $10 Billion |

Investment Tenure | 3 to 5 Years |

Inception Date | 1st January, 2021 |

Annualised Returns | TBD |

Investing Style | Long Terms |

Number of ETFs | 20 to 25 |

Average Market Cap | Over $10 Billion |

Investment Tenure | 3 to 5 Years |

Inception Date | 1st January, 2021 |

Annualised Returns | TBD |

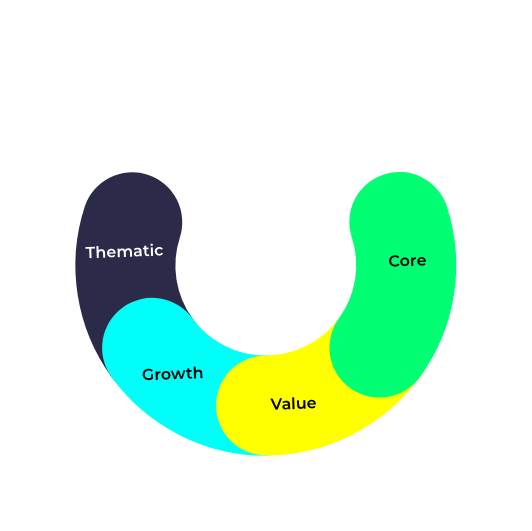

Tenjin AI Explorer adopts an aggressive strategy that consists of a perfect blend of growth, value, momentum, and niche thematic stocks. This strategy aims to identify stocks that provide short term as well as long term gains.

You don’t have to, we will. Based on your risk questionnaire, Tenjin will help determine the best allocation for you.

† indicates results from backtesting with 2015-2021 YTD data. Any backtest based returns are hypothetical in nature and may not reflect future performance. Results represents a Tenjin Basic/Advanced/Pro portfolio with an ‘Aggressive’ risk profile. Portfolios with ‘Conservative’ and ‘Moderate’ risk strategies in it may have experienced lower returns. Past performance is no guarantee for future results. All investments are subject to market risks. All returns both actual and hypothetical from backtests are net of fees

† indicates results from backtesting with 2015-2021 YTD data. Any backtest based returns are hypothetical in nature and may not reflect future performance. Results represents a Tenjin Basic/Advanced/Pro portfolio with an ‘Aggressive’ risk profile. Portfolios with ‘Conservative’ and ‘Moderate’ risk strategies in it may have experienced lower returns. Past performance is no guarantee for future results. All investments are subject to market risks. All returns both actual and hypothetical from backtests are net of fees

Tenjin AI Capital LLC is an SEC registered investment adviser. By using this website, you accept our Terms of Use and Privacy Policy. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities.

Past performance is no guarantee of future results. Any historical returns, expected returns [or probability projections] are hypothetical in nature and may not reflect actual future performance. Account holdings are for illustrative purposes only and are not investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Tenjin’s investment advisory services.

Investment losses are possible, including the potential loss of all amounts invested. Brokerage services are provided to Tenjin Clients by Interactive Brokers, an SEC registered broker-dealer and member FINRA/SIPC. For more information, see our disclosures. Contact: 5 Penn Plaza, New York, NY 10001. Information provided by Tenjin AI Support is for informational and general educational purposes only and is not investment or financial advice.

© 2025Tenjin

Tenjin AI Capital LLC is an SEC registered investment adviser. By using this website, you accept our Terms of Use and Privacy Policy. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities.

Past performance is no guarantee of future results. Any historical returns, expected returns [or probability projections] are hypothetical in nature and may not reflect actual future performance. Account holdings are for illustrative purposes only and are not investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Tenjin’s investment advisory services.

Investment losses are possible, including the potential loss of all amounts invested. Brokerage services are provided to Tenjin Clients by Interactive Brokers, an SEC registered broker-dealer and member FINRA/SIPC. For more information, see our disclosures. Contact: 5 Penn Plaza, New York, NY 10001. Information provided by Tenjin AI Support is for informational and general educational purposes only and is not investment or financial advice.