The journey to financial freedom can be a long one, but purchasing a home early in your life is one way to accelerate your progress. A key concept to understand as you embark on this journey is mortgage amortization. While the term “amortization” might sound a bit intimidating, it’s actually quite straightforward.

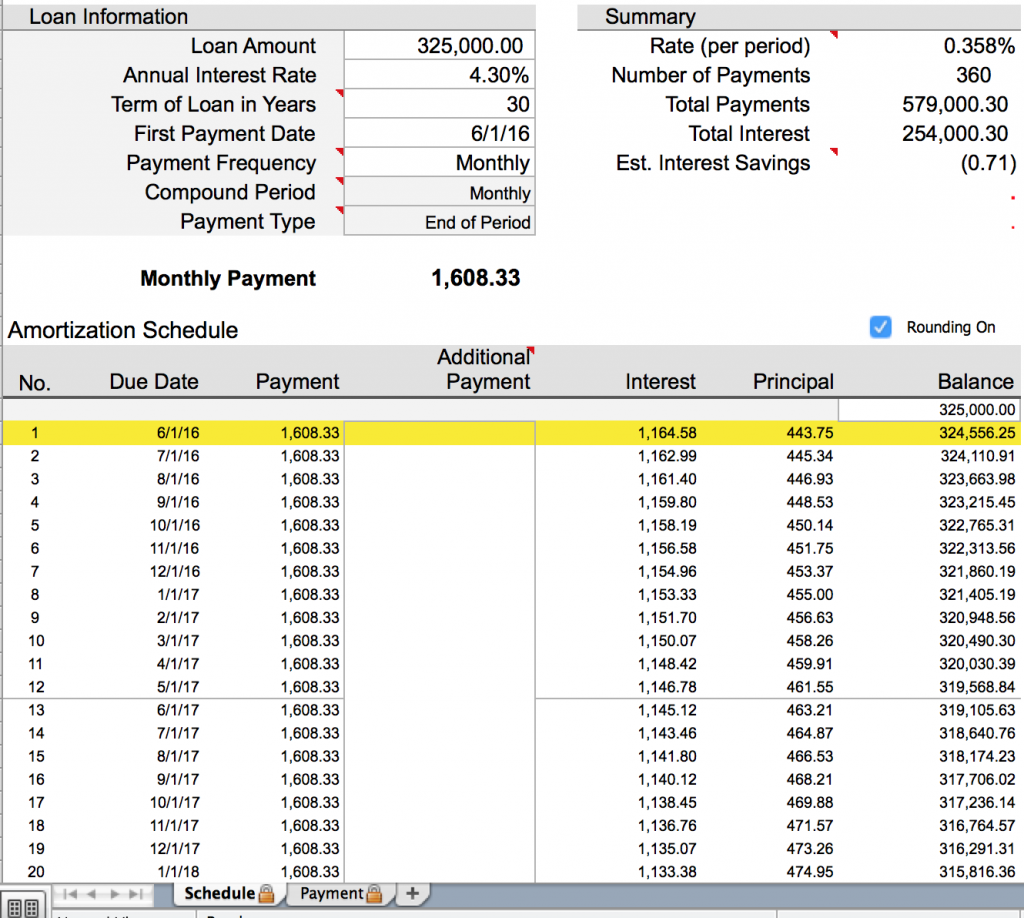

Sample Amortization Schedule

Understanding Amortization

Amortization is the process of gradually paying down a loan over a set period, with each payment typically covering both principal and interest. Once you close on your home and move in, you’ll enjoy a month without a mortgage payment, thanks to the fact that mortgages are paid in arrears—meaning you pay for the previous month’s housing costs.

When your first mortgage payment is due (or automatically deducted from your account), it will consist of two main components:

- Principal: This portion of your payment goes directly toward reducing your loan balance.

- Interest: This portion covers the interest charges on your loan.

If you examine a mortgage amortization schedule, you’ll notice that in the early years of your loan, a larger portion of your payment goes toward interest, with only a small amount reducing your principal. Over time, this balance shifts, and you start paying more toward the principal and less toward interest. This shift is determined by the amortization schedule, which dictates the allocation of your payments between interest and principal over the life of the loan.

Sample Amortization Schedule

Let’s say you borrow $400,000 through a doctor loan at an interest rate of 6.00% over 30 years. In the first month, your payment might be around $2,399. Out of that amount, $2,000 would go toward interest, while only $398.20 would reduce your principal balance.

Will I Always Pay More Interest?

In the early stages of your loan, yes—more of your payment will go toward interest. However, as the loan matures, the scales gradually tip in favor of paying down the principal. In our example, this tipping point occurs around payment 222, when your payment starts applying more to principal ($1,199.25) than to interest ($1,198.96).

How Can I Save Money on My Mortgage?

One effective strategy to reduce the total interest you pay over the life of the loan is to make an extra payment each year. By paying just one additional monthly payment annually, you can significantly shorten your loan term and save a substantial amount of money. This simple step can help you reach financial freedom sooner and make your homeownership journey more comfortable.

If you’re ready to learn more about physician loans and how they can benefit you, be sure to check out our comprehensive guide on doctor mortgage loans.