Ah, choices—so many decisions to make! If you’re a new resident preparing for your post-Match Day move, or an established physician considering a relocation, one of the biggest questions on your mind is likely:

“Should I rent or buy a home with a physician loan mortgage?”

This question isn’t just for new residents; it’s relevant for any doctor moving to a new city or state. Thankfully, physician loans offer unique benefits that can make buying a home an attractive option early in your career. But is it the right choice for you? Let’s explore the factors that might influence your decision.

Factors to Consider in Your Decision

Flexibility

Both renting and buying offer different kinds of flexibility. Renting allows you to move freely each year without worrying about maintenance issues—perfect for those who value mobility. On the other hand, owning a home gives you the freedom to make improvements and tailor your living space to your liking. However, with ownership comes the responsibility of handling repairs and maintenance, which can become costly, especially in older homes.

How Long Do You Plan on Staying?

The length of time you plan to stay in an area is a significant factor in your decision. If you anticipate staying in one place for three years or more, buying a home might be more advantageous, allowing you to build equity over time. Ask yourself, “Would I regret not buying a house if I end up staying here longer?” If the answer is yes, buying could be the right move for you.

Job Stability and Opportunities

If you feel confident about your job stability and plan to stay in your residency or chosen area for the long term, buying a home might be a smart choice. However, if the local job market is uncertain or you’re unsure about your future plans, renting could offer the flexibility you need.

Housing Market Conditions

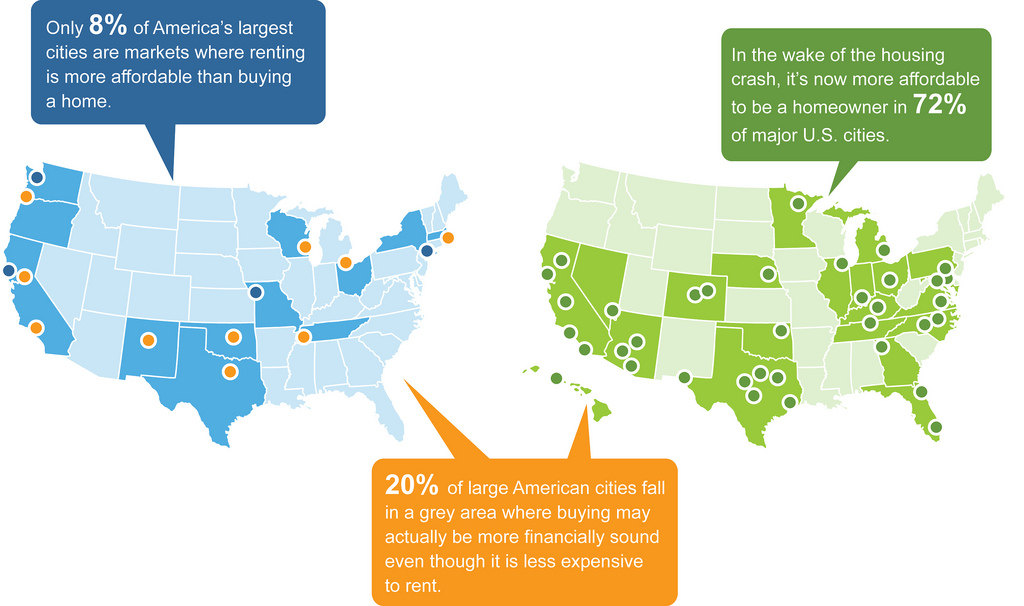

It’s essential to research the housing market in your new city before making a decision. Is it a buyer’s or seller’s market? Are home prices stable, rising, or falling? Understanding these dynamics can help you determine whether it’s a good time to buy or if renting might be more prudent.

Your Credit Score

While physician loans are designed to make it easier for doctors to secure a mortgage, your credit score still plays a crucial role. A higher credit score can lead to better loan terms and lower interest rates, so it’s worth checking your credit and improving it if necessary before applying.

Pets and Living Space

If you have pets, finding a rental that suits your needs can be challenging and often comes with higher costs. Owning your home gives you more freedom to accommodate your furry friends and create a space that’s truly your own.

Considering Being a Landlord?

If you’re a new resident or relocating physician, you might consider keeping and renting out your previous home. Property management companies can handle the day-to-day responsibilities, making it easier for you to manage rental property while focusing on your career. This option isn’t for everyone, but it could be a profitable venture if it aligns with your long-term goals.

Comparing Payments

When comparing the costs of renting versus buying, remember that a portion of your mortgage payment goes toward building equity in your home—essentially, it’s a form of saving. In contrast, rent payments go entirely to your landlord.

For example, with a $400,000 30-year fixed mortgage at a 6.5% interest rate, your monthly payment might be around $2,528. Of that, $2,150 goes to interest (effectively your “rent”), while $378 goes toward paying off your principal—money you could potentially get back if you sell your home for more than you paid. However, in the fifth year, your payment are the same, but $2,042 goes to interest and $486 goes toward paying off your principal.

If this seems complicated, don’t worry—our vetted lenders can help break down the numbers and guide you to the option that makes the most financial sense for your situation.

Physician Loan Mortgage vs. Renting: What’s the Best Choice?

Ultimately, whether owning a home is a good decision depends on your individual circumstances and goals. Many residents have successfully bought homes with the intent to sell at a profit, often finding it less expensive than renting. Physician loans make homeownership more accessible for doctors, but buying isn’t always the best choice for everyone.

Over the next few weeks, consider what would work best for you and how it will impact your move after Match Day. Making the right decision now will give you one less thing to worry about as you start your new job.

Whatever you decide, start saving now so you’re prepared for the opportunities ahead. And remember, our vetted lenders are here to assist you every step of the way, ensuring that you make the best choice for your unique situation. Don’t hesitate to reach out—we’re here to help you find the path to homeownership that’s right for you.